Outlet malls face unique challenges that distinguish them from traditional enclosed shopping centers—sprawling layouts spanning multiple buildings, outdoor navigation between stores, diverse tenant mixes that change seasonally, and value-conscious shoppers seeking specific deals within limited time windows. Traditional static directory signs and paper maps increasingly fail to meet the expectations of digitally-connected consumers accustomed to on-demand information, personalized recommendations, and intuitive navigation tools in every other aspect of their lives.

Interactive kiosks represent a transformative solution that addresses these challenges while simultaneously enhancing customer satisfaction, increasing dwell time, driving foot traffic to underperforming stores, and providing valuable analytics that inform strategic decisions. Modern kiosk systems combine touchscreen wayfinding, real-time store information, promotional content, and data collection capabilities into comprehensive platforms that serve both shoppers and property management equally.

The global digital signage market in the United States is expected to reach $6.9 billion by 2025, growing by 6.5% annually, with retail environments including outlet malls representing significant portions of this expansion. Yet implementing interactive kiosks requires understanding far more than hardware specifications—successful deployments demand strategic thinking about placement, content strategy, user experience design, and integration with broader property management systems.

This comprehensive guide explores how outlet malls can leverage interactive kiosks to create exceptional customer experiences while achieving measurable business outcomes. You’ll discover the specific capabilities modern kiosk systems provide, strategic placement considerations that maximize effectiveness, content strategies that drive engagement, and implementation best practices that ensure long-term success. Whether you’re considering your first kiosk installation or enhancing existing systems, you’ll find practical insights for creating digital wayfinding solutions that transform how shoppers navigate and experience your property.

From understanding the unique requirements of outdoor outlet environments through selecting appropriate technology platforms and measuring return on investment, we’ll examine how interactive kiosks deliver value throughout the customer journey—from initial arrival confusion through successful purchase and positive departure impressions that drive repeat visits.

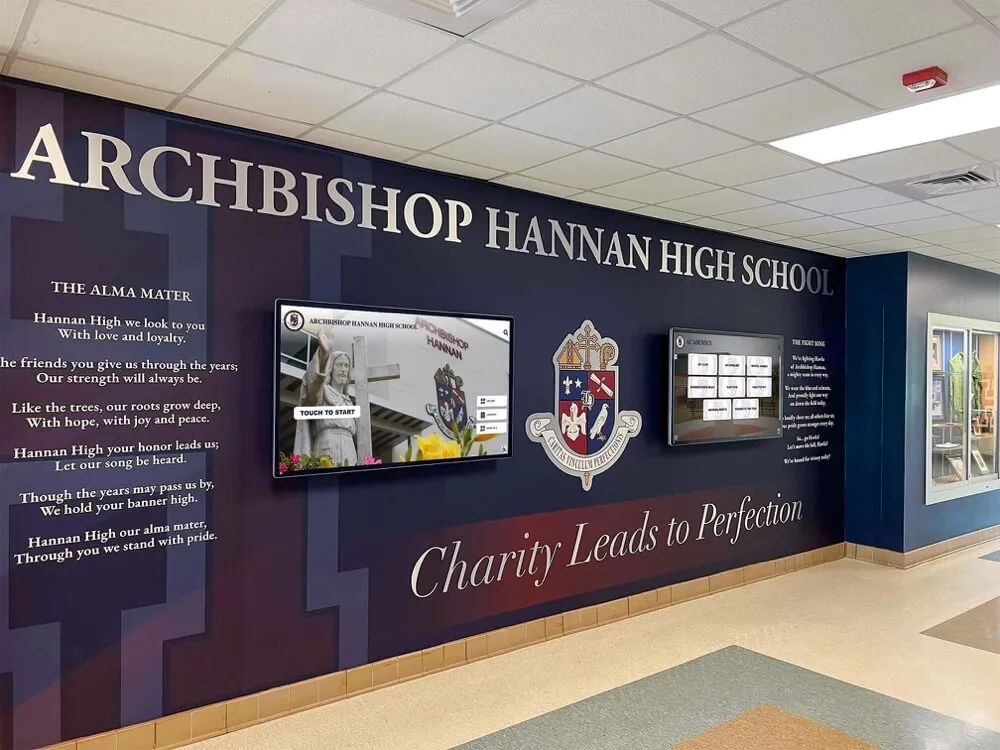

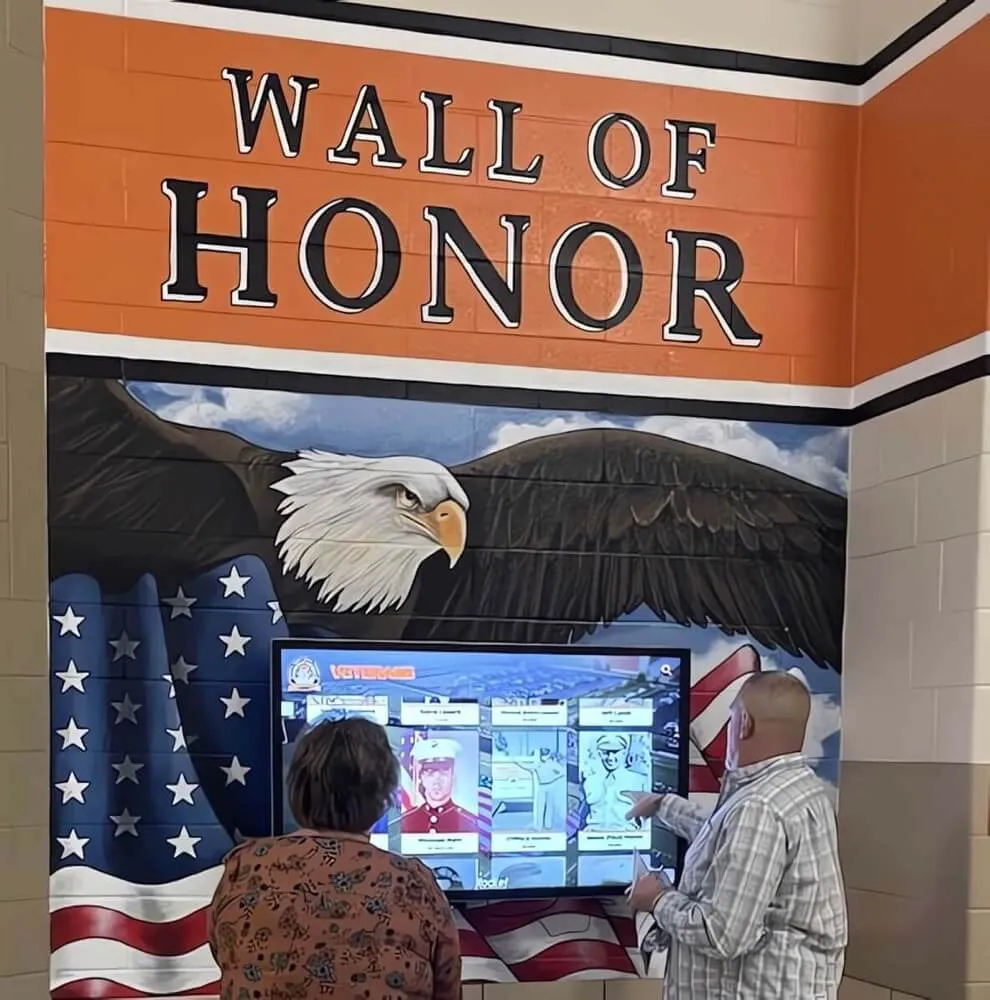

Modern interactive kiosks provide intuitive touchscreen interfaces that shoppers of all ages can use effortlessly to find stores, discover promotions, and navigate complex outlet mall layouts

The Evolution of Outlet Mall Wayfinding and Customer Experience

Outlet malls have undergone dramatic transformation over recent decades, evolving from basic discount shopping destinations into comprehensive retail experiences competing for consumer time and spending against e-commerce, traditional malls, and entertainment venues. This evolution has fundamentally changed how properties must approach customer experience and wayfinding.

Why Traditional Wayfinding Methods No Longer Suffice

For generations, outlet malls relied on static directory signs at key intersections, paper maps available at management offices, and occasional staff assistance to help shoppers navigate properties. While these methods established basic wayfinding infrastructure, they increasingly struggle to meet modern consumer expectations and operational needs:

Static Information Cannot Accommodate Dynamic Retail Environments: Outlet malls experience constant tenant turnover as brands test new markets, seasonal pop-up stores occupy temporary spaces, and store hours vary by retailer and season. Static directory signs become outdated the moment a tenant changes, requiring expensive physical updates that many properties delay due to cost and complexity. This information lag frustrates shoppers who waste time walking to closed stores or searching for retailers that have relocated or departed entirely.

Paper Maps Create Friction and Waste: Physical maps require shoppers to locate distribution points, interpret often-unclear layouts, orient themselves spatially, and carry cumbersome materials while shopping. Many visitors never obtain maps despite needing assistance, while those who do frequently discard them after initial use, creating litter and environmental waste. Paper materials cannot provide personalized recommendations, real-time store information, or dynamic routing based on current conditions like temporary closures or special events.

Limited Staff Cannot Serve Distributed Demand: Outlet malls’ sprawling footprints make centralized customer service impractical—shoppers experiencing navigation challenges far from management offices have no convenient assistance. Hiring sufficient roaming staff to provide comprehensive wayfinding support proves cost-prohibitive, while directing shoppers to distant information desks creates frustration and abandonment as customers leave rather than investing effort seeking help for what should be simple questions.

Lack of Personalization: Generic directories display all tenants equally regardless of individual shopper preferences, making discovery inefficient for visitors with specific goals or interests. Value-conscious outlet shoppers often visit properties seeking particular brands or deals rather than casual browsing, making targeted discovery capabilities increasingly important for customer satisfaction and conversion.

No Data Collection or Analytics: Traditional wayfinding methods provide no insight into how customers navigate properties, which stores generate interest, where confusion occurs, or what promotions drive engagement. This information blindness prevents evidence-based decisions about tenant placement, promotional strategies, or facility improvements that could enhance customer experience and property performance.

Understanding Modern Shopper Expectations and Behaviors

Consumer behavior has shifted dramatically with smartphone ubiquity and digital service expectations established by leading technology companies and e-commerce platforms. These changes directly impact how shoppers expect to interact with physical retail environments:

According to research from Samsung Business Insights, 71% of shoppers want businesses to understand their preferences and provide personalized experiences. Modern consumers expect the same recommendation engines, personalized content, and intuitive interfaces they experience online to extend seamlessly into physical shopping environments. Properties failing to provide these digital conveniences increasingly feel outdated and inconvenient compared to competitors offering more sophisticated customer experiences.

Smartphone dependence has trained consumers to expect instant information access for any question. Shoppers routinely search for store hours, product availability, and directions online—capabilities they increasingly expect within physical retail spaces through similar digital interfaces. However, many outlet mall visitors struggle with cellular connectivity in certain property areas or prefer not to drain phone batteries on extended shopping trips, making standalone interactive kiosks valuable supplements to mobile experiences rather than complete replacements.

Time-constrained shopping behaviors dominate outlet visits more than traditional malls. Many outlet shoppers travel significant distances specifically for deals, arriving with limited time windows and specific goals rather than leisurely browsing. These efficiency-focused behaviors make intuitive wayfinding essential for customer satisfaction—frustrated shoppers unable to quickly locate desired stores often leave without making purchases they would have completed with better navigation assistance.

The Strategic Value of Interactive Kiosk Solutions

Modern interactive kiosks address traditional wayfinding limitations while creating new engagement and data opportunities that traditional methods cannot provide:

Dynamic Content Management: Cloud-based kiosk systems enable instant updates across all devices simultaneously from centralized management interfaces. When tenants change, hours adjust, or promotions launch, updates appear immediately on every kiosk without physical modification or expensive signage replacement. This real-time accuracy ensures shoppers always receive current information, improving satisfaction while reducing operational costs associated with outdated directory maintenance.

Personalized Shopping Assistance: Advanced kiosks function as virtual concierges, adapting to individual preferences and requirements through intuitive interfaces. Shoppers can filter stores by category, search for specific brands, discover ongoing promotions matching their interests, and receive optimized routes visiting multiple destinations efficiently. This personalization creates value similar to experienced human shopping assistants without corresponding labor costs or availability limitations.

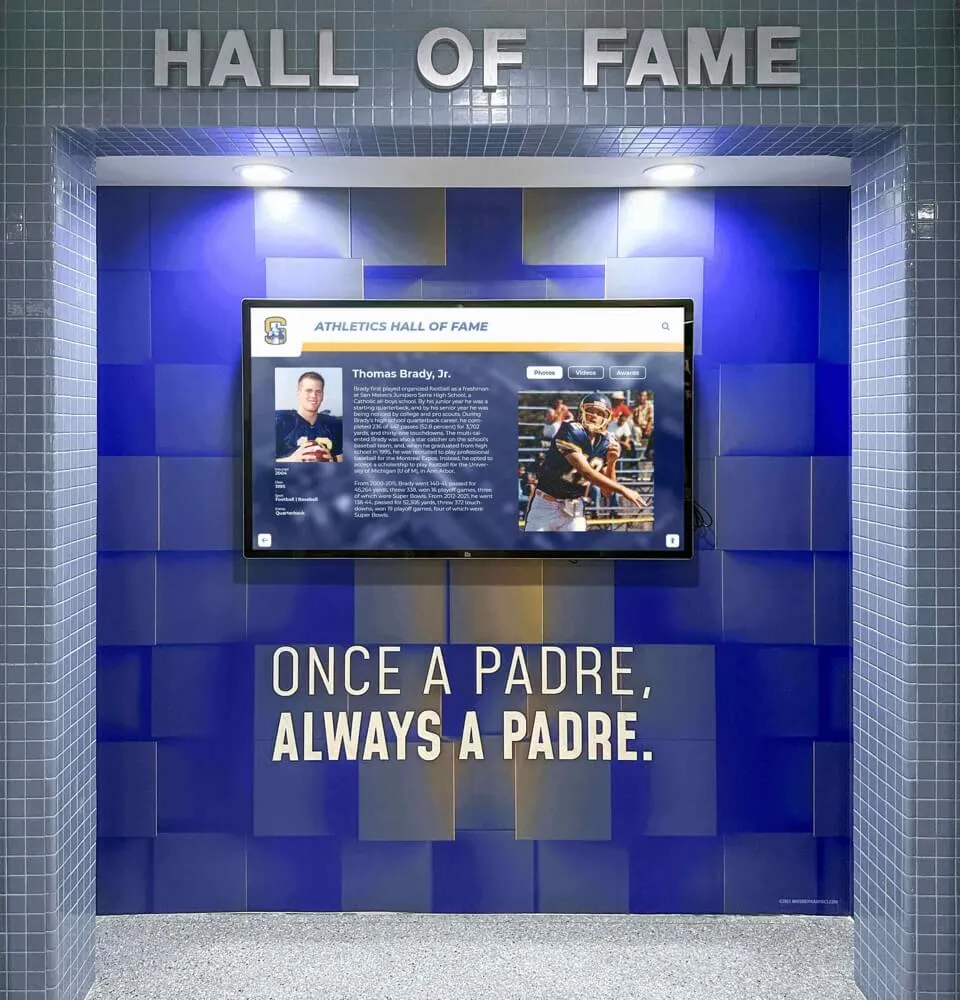

Comprehensive Analytics and Insights: Interactive kiosks capture valuable data about customer behavior patterns, popular search queries, frequently requested stores, and peak usage times. These insights inform strategic decisions about tenant recruitment, store placement, promotional strategies, and facility improvements based on actual customer behavior rather than assumptions. Much like touchscreen software solutions used in other contexts, properties can identify underperforming tenants requiring promotional support, popular brands warranting expansion space, or confusing navigation areas needing wayfinding improvements.

Extended Engagement Opportunities: Beyond pure wayfinding, kiosks serve as marketing platforms showcasing current promotions, upcoming events, loyalty program information, and retailer advertisements. This extended engagement creates additional revenue opportunities through advertising sales while providing shoppers with valuable information that enhances their visits and increases transaction values through promotion awareness.

Accessibility and Inclusivity: Digital kiosks can provide multi-language support, text size adjustments, audio assistance, and other accessibility features serving diverse customer populations more effectively than static signage or printed materials. Similar to how interactive church information displays serve diverse congregations, this inclusivity improves experiences for international visitors, elderly shoppers, those with visual impairments, and other populations that traditional wayfinding methods serve inadequately.

Strategic placement in high-traffic corridors and entrance areas ensures maximum visibility and convenient access when shoppers most need wayfinding assistance

Core Interactive Kiosk Capabilities for Outlet Mall Environments

Successful outlet mall kiosks share common features that address specific customer needs while providing operational value to property management. Understanding these essential capabilities helps properties select solutions meeting their specific requirements.

Digital Wayfinding and Navigation Systems

Navigation functionality represents the fundamental purpose of most outlet mall kiosks, making robust wayfinding capabilities essential for any deployment:

Interactive Floor Plans and 3D Mapping: Modern kiosk systems present property layouts through intuitive visual interfaces that shoppers can explore by touch. High-resolution maps clearly display all tenants, amenities, parking areas, and key facilities with visual clarity that static printed materials cannot match. Advanced systems offer 3D renderings providing more intuitive spatial understanding, particularly valuable for multi-level properties or complex layouts where traditional 2D maps create confusion.

“You Are Here” Positioning: Clear indication of the kiosk’s physical location within the property helps shoppers orient themselves spatially before planning routes. Some advanced systems integrate indoor positioning technologies like Wi-Fi triangulation or Bluetooth beacons to provide even more precise location awareness, particularly valuable across sprawling outlet properties where spatial orientation challenges exceed traditional enclosed malls.

Search and Discovery Features: Comprehensive search functionality enables shoppers to find specific stores by name, browse categories, filter by brand type, or discover tenants offering particular products or services. Intuitive search reduces navigation to typing or speaking store names rather than visually scanning extensive alphabetical directories, dramatically improving efficiency for goal-oriented shoppers seeking specific destinations.

Route Optimization and Turn-by-Turn Directions: After selecting destinations, effective kiosks generate optimized walking routes considering distance, current weather conditions, and accessibility requirements. Turn-by-turn visual directions show shoppers exactly where to go, with some systems offering mobile transfer capabilities allowing visitors to send directions to smartphones for reference while walking. For shoppers planning multiple store visits, route optimization features calculate efficient sequences minimizing backtracking and walking distance.

Multi-Destination Trip Planning: Outlet shoppers frequently visit multiple stores during single trips. Advanced kiosks enable adding several destinations to itineraries, then automatically optimize route sequences for maximum efficiency. This multi-stop planning proves particularly valuable at large outlet properties where inefficient routing could add significant walking distances and time.

Real-Time Status Information: Integration with tenant systems enables displaying current information about store hours, temporary closures, extended holiday schedules, or special shopping events. Real-time status prevents frustrating experiences of walking to closed stores or missing time-limited sales, improving overall customer satisfaction significantly.

Promotional Content and Advertising Platforms

Beyond pure wayfinding, kiosks serve as dynamic marketing channels showcasing promotions, events, and advertising content that benefit both properties and tenants:

Current Sales and Promotion Showcases: Dedicated sections highlighting ongoing sales, special offers, clearance events, and limited-time promotions help shoppers discover deals they might otherwise miss. Promotion awareness drives foot traffic to participating retailers while increasing transaction values as customers make unplanned purchases inspired by advertised deals. According to kiosk industry research, promotional content displayed on wayfinding kiosks can increase store visits by 15-30% compared to tenants without featured promotion visibility.

Event Calendars and Entertainment Information: Many outlet properties host seasonal events, holiday activities, live entertainment, or special shopping experiences that enhance customer visits. Kiosks effectively communicate these events through calendars, countdown timers, and detailed information including times, locations, and participation details. Similar to how venues leverage fan experience centers to enhance visitor engagement, event promotion increases visit frequency and dwell time while creating memorable experiences that differentiate properties from purely transactional shopping destinations.

Tenant Advertising Opportunities: Kiosks create revenue opportunities through paid advertising placements allowing individual retailers to purchase prominent feature positions, video showcases, or targeted promotions appearing when relevant categories are browsed. This advertising inventory generates incremental property revenue while providing tenants with targeted marketing opportunities reaching high-intent shoppers actively planning visits to their stores.

Loyalty Program Integration: Properties operating customer loyalty programs can integrate program information, enrollment capabilities, and member benefits displays within kiosk interfaces. Visible loyalty promotion increases enrollment while reminding existing members about available benefits, driving program utilization that increases visit frequency and customer lifetime value.

Seasonal Content Flexibility: Cloud-based content management enables rapidly adapting kiosk displays for seasonal themes, holiday shopping periods, or special property initiatives. This visual flexibility maintains fresh, relevant appearances that align with broader property marketing while celebrating seasonal events that enhance emotional connections and shopping enjoyment.

Store and Tenant Information Databases

Comprehensive databases providing detailed information about all tenants transform kiosks from simple directories into sophisticated discovery tools:

Store Profiles with Rich Details: Beyond basic names and locations, robust kiosk systems present detailed profiles for each tenant including merchandise categories, price positioning, typical product offerings, and brand descriptions. These profiles help shoppers determine which stores match their interests before walking to locations, improving efficiency while reducing abandoned visits to stores selling unexpected merchandise types.

Operating Hours and Contact Information: Display of store-specific hours, phone numbers, website links, and social media handles enables shoppers to verify current status or contact tenants directly with questions. This detailed information proves particularly valuable at outlet properties where tenant hours may vary significantly rather than following uniform property schedules.

Accessibility Information: Details about wheelchair accessibility, dressing room availability, special services offered, or other relevant facility information helps shoppers with specific needs identify appropriate stores efficiently. This inclusive information benefits elderly visitors, those with mobility challenges, families with young children requiring specific facilities, and others whose shopping experiences depend on access to particular accommodations or services.

Category and Brand Filtering: Sophisticated filtering capabilities enable shoppers to discover stores by category, brand name, price range, or merchandise type without knowing specific tenant names. This discovery functionality proves essential for visitors unfamiliar with all property tenants or those seeking general categories like “women’s athletic wear” rather than specific brands.

New Store Announcements: Highlighting recently opened locations, upcoming tenant arrivals, or newly relocated stores within properties ensures shoppers remain aware of evolving tenant mixes. New store promotion benefits properties by driving traffic to recent additions while helping retailers achieve successful launches through enhanced visibility.

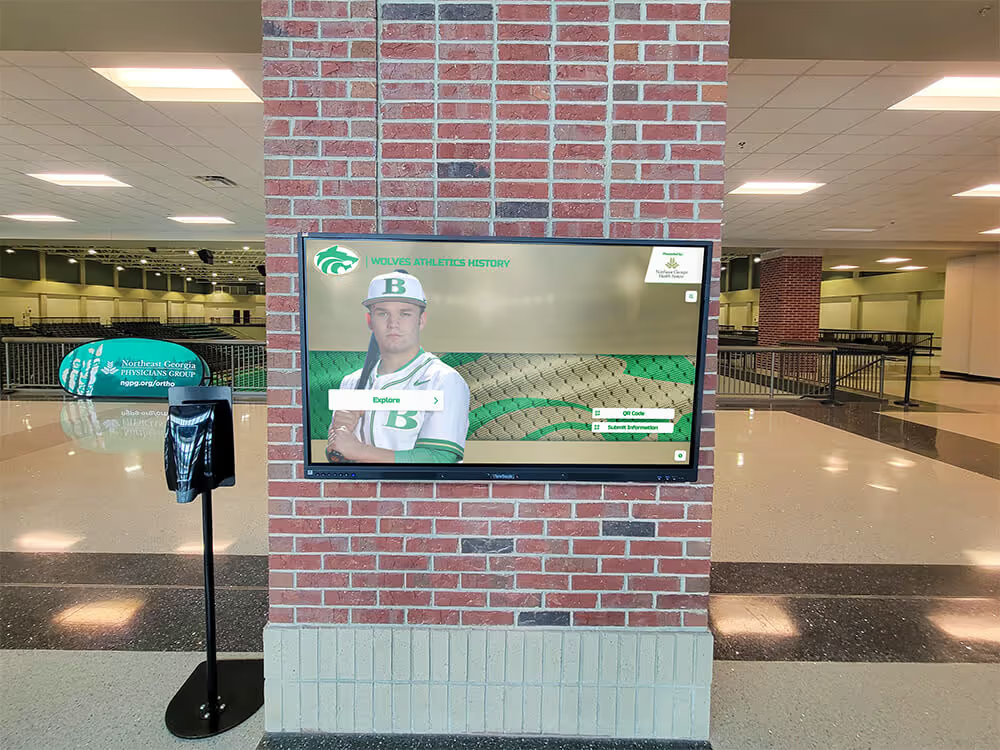

Intuitive touchscreen interfaces enable shoppers to quickly search for stores, browse categories, and access detailed information without assistance or prior training

Amenity and Service Information

Beyond retail tenants, outlet malls provide numerous amenities and services that visitors need to locate and understand:

Dining and Food Service Directories: Food courts, restaurants, and casual dining locations represent important amenities that influence visit duration and overall satisfaction. Detailed dining information including cuisine types, price ranges, hours, and locations helps hungry shoppers quickly find appropriate options without randomly wandering or leaving properties for nearby restaurants.

Restroom and Family Facility Locations: Few questions arise more frequently than “where’s the nearest restroom?” Prominent restroom location features save staff time addressing repetitive inquiries while improving customer comfort through quick access to needed facilities. Family amenities like nursing rooms, diaper changing stations, and family restrooms deserve similar prominent placement serving visitors with young children.

Parking and Transportation Information: Large outlet properties often feature multiple parking areas, sections, or structures that confuse visitors. Kiosks displaying parking locations, available spaces, shuttle schedules, or transportation options help shoppers remember where they parked while assisting new arrivals in locating closest parking to desired stores. Some advanced systems integrate with parking sensors showing real-time availability by section, helping visitors avoid circling full areas searching for spaces.

Guest Services and Amenities: Information about ATM locations, charging stations, Wi-Fi access, package storage, stroller rentals, wheelchair availability, and customer service desk locations improves convenience while demonstrating comprehensive service orientation. Showcasing these amenities increases utilization while reducing staff burden answering routine questions about facility locations and services.

Emergency Information and Safety Features: Kiosks provide valuable platforms for emergency information including evacuation routes, AED locations, and emergency contact procedures. During actual emergencies, management can push urgent alerts to all kiosks simultaneously, leveraging the network as a property-wide notification system reaching customers throughout facilities quickly.

Analytics and Business Intelligence Capabilities

Behind the scenes, sophisticated kiosk systems collect valuable data providing insights that inform strategic decisions:

Usage Pattern Analytics: Tracking metrics like total interactions, peak usage times, average session duration, and popular features reveals how customers engage with kiosks. These patterns inform placement decisions, content strategies, and staffing schedules while demonstrating return on investment through quantifiable utilization data.

Search and Discovery Insights: Analyzing most-searched stores, popular categories, and frequent discovery patterns reveals customer interests and navigation challenges. Stores generating high search volume but low subsequent visits might need promotional support or clearer physical signage, while frequently searched categories with limited tenant representation suggest tenant recruitment opportunities addressing unmet demand.

Foot Traffic Patterns: Some advanced kiosk systems integrate with property-wide analytics tracking customer movement patterns following kiosk usage. These insights reveal whether users successfully reach intended destinations, identify navigation confusion points requiring improved signage or modified routes, and demonstrate kiosk effectiveness in driving traffic to specific property areas or tenants.

Promotional Effectiveness Measurement: Tracking engagement with featured promotions, advertisement interactions, and promotion-to-action conversion provides valuable data about marketing effectiveness. Properties can identify which promotion types generate strongest engagement, optimize featured content based on actual performance, and demonstrate advertising value to tenant partners considering paid placement opportunities.

Seasonal and Temporal Trends: Long-term data collection reveals seasonal patterns, peak shopping periods, changing customer interests over time, and evolving wayfinding needs. These insights support strategic planning about property improvements, tenant recruitment priorities, promotional calendars, and infrastructure investments delivering maximum impact based on actual usage patterns rather than assumptions.

Modern touchscreen technology responds instantly to user input, creating intuitive experiences that shoppers of all technical comfort levels can navigate successfully

Strategic Placement and Deployment Considerations

Hardware capabilities matter, but strategic placement decisions determine whether kiosks actually achieve utilization goals and deliver expected value. Successful deployments require careful analysis of customer flow patterns, property layouts, and specific wayfinding challenges.

Optimal Location Selection Principles

Research from retail technology providers indicates that kiosk placement significantly impacts usage rates, with well-positioned units achieving 3-5 times higher interaction rates than poorly located installations:

Primary Entry Point Positioning: Kiosks installed at main entrances capture shoppers precisely when they most need wayfinding assistance—upon arrival before they’ve oriented themselves spatially or planned routes. Entry-point placement establishes helpful first impressions while ensuring maximum visibility as every visitor passes these locations. For properties with multiple entry points, installing kiosks at each ensures comprehensive coverage regardless of arrival patterns.

Central Gathering Areas: Common areas where shoppers naturally gather, pause, or transition between property sections provide excellent secondary placement opportunities. Food court entrances, major pathway intersections, and central plaza areas generate substantial foot traffic with built-in dwell time as visitors decide where to go next, creating natural opportunities for kiosk consultation.

Parking Structure Interfaces: The transition from parking to shopping areas represents another high-value placement opportunity where orientation confusion commonly occurs. Shoppers emerging from parking structures or lots benefit from immediate wayfinding access helping them navigate unfamiliar properties efficiently from arrival rather than wandering aimlessly after parking.

Remote Property Sections: Large outlet properties often feature separated buildings, distant wings, or standalone structure clusters that feel disconnected from central areas. Strategic kiosk placement in these remote sections serves shoppers who’ve walked from central areas and need re-orientation or direction to additional destinations without returning to main entrances.

Near Major Anchor Tenants: High-traffic anchor stores generate substantial foot traffic that can be redirected to smaller tenants through strategically placed nearby kiosks. Shoppers visiting popular anchors often browse additional stores opportunistically, making discovery tools near major traffic generators valuable for driving visits to lesser-known tenants who might otherwise be overlooked.

Quantity and Coverage Optimization

Determining appropriate kiosk quantities requires balancing comprehensive coverage against costs and management complexity:

Distance and Visibility Guidelines: Industry standards suggest kiosks should be visible from most property locations without requiring more than 2-3 minute walks, ensuring convenient access when shoppers need assistance. Outlet properties typically require more units per square foot than enclosed malls due to sprawling layouts and outdoor navigation challenges that create more frequent wayfinding needs.

Traffic Volume Considerations: High-traffic periods shouldn’t create wait times exceeding 1-2 minutes for kiosk access. Properties experiencing congestion at existing kiosks during peak shopping seasons should deploy additional units relieving pressure and reducing abandonment by impatient shoppers unwilling to wait for assistance.

Phased Deployment Approaches: Many properties benefit from phased implementations starting with 3-5 strategically placed kiosks at highest-priority locations, then expanding based on initial usage data and identified gaps. This approach manages upfront investment while enabling evidence-based expansion addressing actual needs rather than assumed requirements that may not align with real usage patterns.

Redundancy for Critical Locations: Main entrances and other critical high-traffic areas may warrant multiple kiosks providing redundancy during peak periods and ensuring continuous availability if individual units experience technical issues. Redundancy prevents single points of failure that could leave primary entry points without wayfinding support during high-traffic periods when assistance proves most valuable.

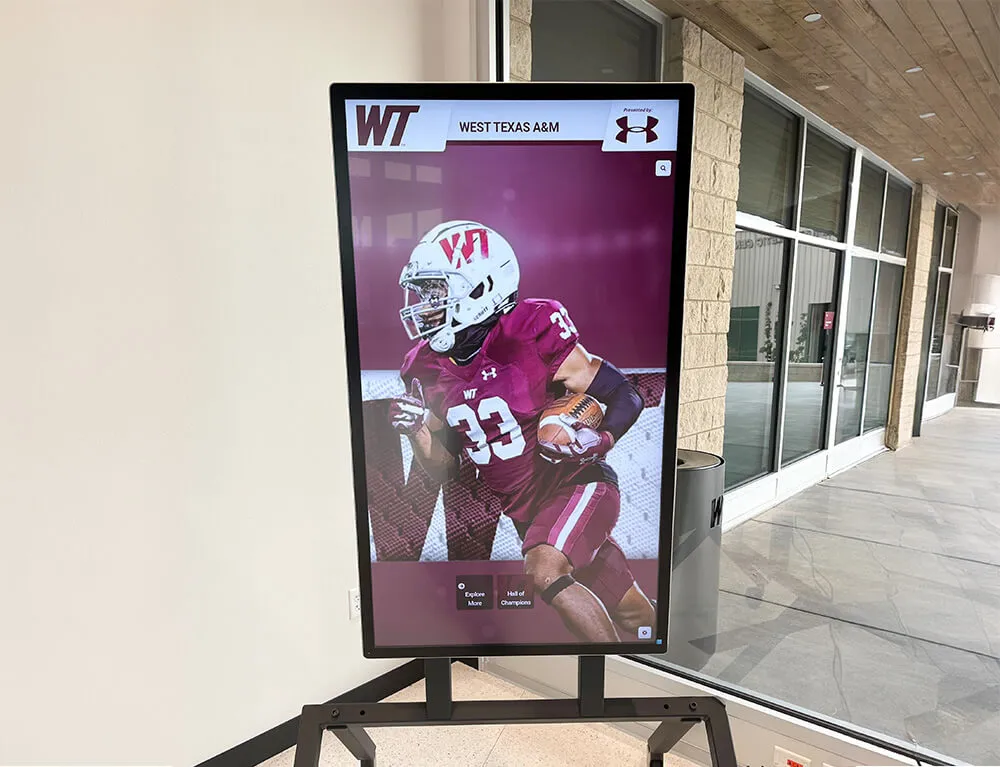

Outdoor and Weather Considerations

Outlet malls’ outdoor navigation creates unique technical challenges that enclosed properties don’t face:

Sunlight Readability Requirements: Standard indoor displays become invisible in direct sunlight. Outdoor kiosk installations require specialized high-brightness screens typically 2-5 times brighter than indoor models, with anti-reflective coatings and hoods or recessed mounting reducing glare. According to kiosk manufacturers, outdoor displays should provide minimum brightness of 1,000-2,500 nits compared to 300-500 nits sufficient for indoor applications.

Temperature Control and Climate Protection: Electronics require specific operating temperature ranges for reliability and longevity. Outdoor kiosks need environmental controls maintaining internal temperatures within acceptable ranges despite external heat, cold, or humidity. This requires sealed weatherproof enclosures, heating elements for cold climates, cooling systems or ventilation for hot environments, and humidity controls preventing condensation damage to sensitive components.

Physical Durability and Vandalism Resistance: Outdoor installations face greater risk of vandalism, accidental damage, or environmental wear than protected indoor locations. Commercial-grade outdoor kiosks feature reinforced construction, impact-resistant glass, tamper-resistant fasteners, and protective enclosures that withstand weather, physical abuse, and attempted theft while maintaining professional appearance through years of service.

Accessibility in Varied Weather: During rain, snow, or extreme heat, unprotected outdoor kiosk placement may discourage use regardless of display visibility. Covered locations, integrated canopies, or positioning under existing weather protection ensures functionality during adverse conditions when wayfinding assistance may prove most valuable as shoppers prefer minimizing outdoor exposure.

Technical Infrastructure Requirements

Successful kiosk deployment depends on adequate supporting infrastructure that many properties underestimate during planning:

Network Connectivity: Cloud-based kiosk systems require reliable internet connections for content updates, real-time information display, and analytics reporting. Properties should provide wired ethernet connections whenever possible for maximum reliability, with wireless backup preventing outages if primary connections fail. Cellular connectivity serves as additional fallback for truly remote locations where wired installation proves cost-prohibitive.

Electrical Power: Kiosks require continuous power, typically 110V electrical outlets with surge protection. Planning should address power availability at intended locations during design phases rather than discovering infrastructure gaps after purchase, which creates expensive retrofit requirements or forces compromise placement decisions based on power availability rather than optimal customer service locations.

Physical Mounting and Foundation Requirements: Freestanding outdoor kiosks require substantial foundations preventing wind damage or toppling, while wall-mounted units need adequate structural support for weight and usage forces. Properties should conduct site surveys assessing foundation requirements, mounting surface suitability, and any underground utilities affecting installation before finalizing location decisions.

Ongoing Maintenance Access: Installation locations should provide reasonable staff access for routine cleaning, content updates, technical service, and repairs without requiring specialized equipment or creating safety hazards. Second-floor or rooftop installations that seem attractive from customer visibility perspectives may prove problematic if maintenance requires scaffolding, lifts, or extended service visits.

Integrated installations that complement rather than clash with existing property aesthetics create cohesive environments where technology feels purposefully designed rather than awkwardly added as afterthought

Content Strategy and User Experience Design

Hardware installation represents only half the equation—compelling content and intuitive user experiences determine whether shoppers actually engage with kiosks productively. Successful implementations prioritize customer needs through thoughtful design decisions.

Interface Design Principles for Self-Service Success

Research from retail technology providers demonstrates that interface design dramatically impacts utilization, with poorly designed kiosks achieving less than 30% of the engagement rates that well-designed counterparts deliver:

Immediate Comprehension Without Instructions: Effective kiosk interfaces communicate purpose and operation instantly through visual design alone without requiring posted instructions, staff demonstrations, or experimentation. Prominent “Find a Store” or “Search Directory” buttons using universally understood icons and clear labeling ensure first-time users understand exactly how to begin without hesitation or confusion.

Large Touch Targets and Clear Typography: Touchscreen interfaces must accommodate users of all ages, visual abilities, and technical comfort levels. Minimum touch target sizes of 1-1.5 inches prevent frustration from missed taps, while high-contrast typography sized appropriately for typical viewing distances ensures comfortable readability without squinting or moving closer to screens.

Minimal Navigation Depth: Every additional screen tap or menu level exponentially increases abandonment risk. Well-designed kiosk interfaces enable reaching most common goals within 2-3 taps maximum, with critical functions like store search, promotion viewing, and amenity locations accessible directly from home screens without navigating through nested menus.

Visual Rather Than Text-Heavy Design: Shoppers scan rather than read carefully, making visual communication more effective than text-heavy explanations. Map-based interfaces, icon navigation, image-rich store profiles, and visual wayfinding directions communicate faster and more universally than written instructions, while supporting non-native language speakers and those with literacy challenges more effectively.

Responsive Feedback and Confirmation: Interactive elements should provide immediate visual or audio feedback confirming user actions registered successfully. Buttons that change appearance when touched, progress indicators during searches or route calculations, and confirmation messages after selections reassure users that systems respond correctly, preventing repeated taps from users uncertain whether initial inputs registered.

Content Creation and Management Workflows

Maintaining current, accurate, engaging content requires systematic workflows and clear organizational responsibility:

Centralized Content Management Systems: Modern kiosk platforms provide cloud-based content management enabling updates from any internet-connected device without physical access to installations. Centralized management allows instantly updating all property kiosks simultaneously when information changes, ensuring consistency while eliminating tedious manual updates at individual locations that traditional signage requires.

Clear Content Ownership and Approval: Establish explicit responsibility for different content types—property marketing teams manage promotional features and property-wide information, leasing departments maintain tenant databases and new store announcements, operations teams update facility information and amenity details. Clear ownership prevents outdated content from persisting because nobody claims update responsibility while avoiding conflicting changes from multiple editors without coordination.

Regular Audit and Refresh Schedules: Schedule systematic content reviews ensuring accuracy rather than relying on reactive updates only when errors surface. Monthly audits verifying tenant information, hours, locations, and promotional content remain current catch changes before customers encounter outdated information that damages credibility and trust. Seasonal refreshes updating visual themes, featured content, and promotional focuses maintain fresh appearance preventing kiosks from feeling stale through unchanging presentations.

Tenant Self-Service Portals: Some advanced kiosk platforms provide tenant-facing portals enabling retailers to update their own profiles, hours, promotions, and featured content within property-approved parameters. This distributed approach keeps information current without burdening property staff while giving tenants ownership over their presentation and promotional opportunities.

Testing Before Publication: Content management systems should include preview and staging capabilities enabling content review before public deployment. Testing updated maps, modified interfaces, or new features in controlled environments prevents embarrassing errors or broken functionality appearing on customer-facing kiosks, maintaining professional quality and system reliability.

Multi-Language Support and Accessibility

Outlet malls serve diverse customer populations requiring inclusive design supporting varied needs:

Comprehensive Language Options: Properties serving international visitors or communities with significant non-English-speaking populations should provide multi-language support covering all interface elements, store information, and wayfinding directions. Much like interactive displays in courtrooms that serve diverse audiences, prominent language selection on home screens enables immediate switching, while systems that remember language preferences for session duration prevent repetitive selection if users explore multiple features.

Text Scaling and High-Contrast Modes: Accessibility features enabling text size adjustment and high-contrast visual modes serve elderly shoppers, those with visual impairments, and anyone experiencing difficulty reading default presentations. These options should be prominently accessible rather than buried in settings menus, with clear iconic representation communicating purpose to users unfamiliar with accessibility terminology.

Audio Assistance Options: Some sophisticated systems offer audio output reading on-screen information for users with significant visual impairments or literacy challenges. Audio assistance combined with simple navigation enables these users to access wayfinding information independently rather than requiring staff assistance for basic questions.

Wheelchair-Accessible Installation Heights: Physical mounting should accommodate wheelchair users through appropriate screen heights and clear floor space for maneuvering. The Americans with Disabilities Act (ADA) provides specific guidelines for accessible interactive displays that commercial installations should meet or exceed, ensuring equal access regardless of physical ability.

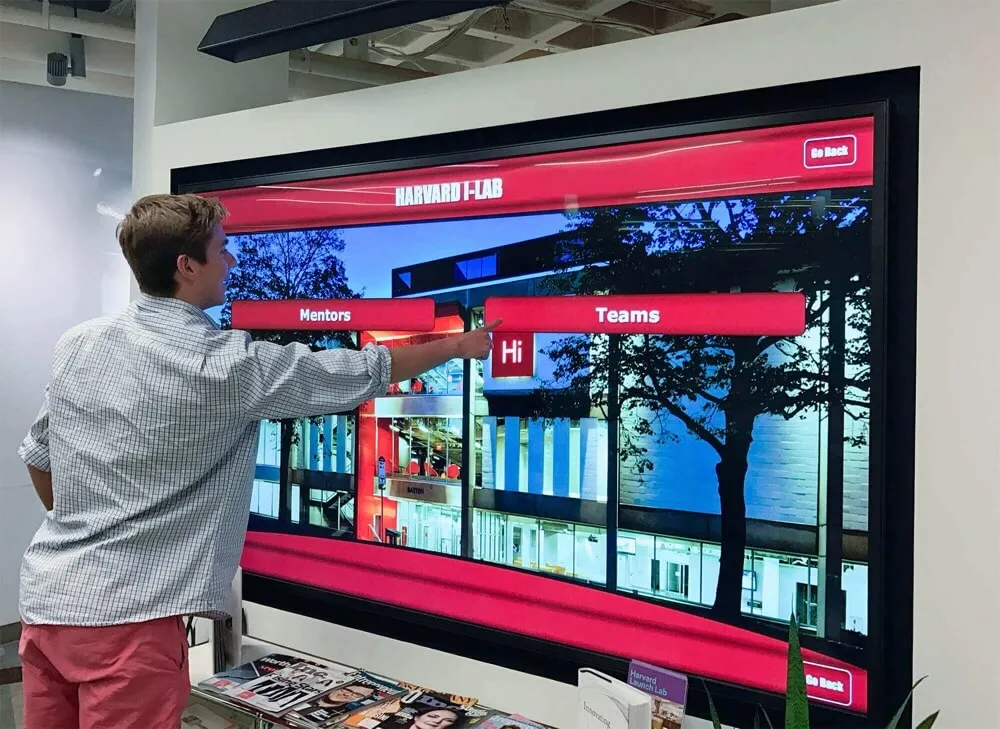

Group-friendly displays enable multiple shoppers to view and discuss options simultaneously, supporting families and groups planning coordinated shopping strategies

Technology Selection and Vendor Evaluation

The outlet mall kiosk market includes numerous hardware manufacturers, software providers, and turnkey solution vendors with significant variation in capabilities, costs, and long-term viability. Selecting appropriate partners proves as important as feature evaluation for successful deployments.

Hardware Specifications and Commercial-Grade Requirements

Consumer-grade displays fundamentally differ from commercial installations designed for continuous operation in public environments:

Commercial Display Durability: Commercial-rated touchscreens typically warrant 50,000-100,000 touch cycles or more compared to consumer devices designed for occasional home use. They withstand constant daily use by hundreds or thousands of shoppers without performance degradation. Industrial-grade components, reinforced construction, and thermal management systems enable reliable 24/7 operation through years of service rather than months before failure.

Screen Size and Resolution Considerations: Outlet mall kiosks typically feature 32-55 inch displays balancing visibility from distance against installation space and costs. High-resolution panels (minimum 1920x1080, preferably 4K) ensure crisp text and map details remain clear at typical viewing distances. Larger screens improve visibility and enable richer content but increase costs and physical space requirements that may limit placement options.

Touchscreen Technology Options: Capacitive touchscreens used in smartphones and tablets provide excellent sensitivity and multi-touch capability but may struggle with outdoor conditions or gloved use. Infrared touchscreens using invisible light grids offer superior durability, work with gloves, and prove more cost-effective for large formats, making them popular for commercial kiosk applications. Surface acoustic wave and resistive technologies offer additional alternatives with specific advantages for certain environments or budget constraints.

Processing Power and Performance: Responsive interfaces require adequate computing power preventing lag, stuttering animations, or slow map rendering that frustrates users and appears unprofessional. Minimum specifications should include current-generation processors (Intel Core i5 equivalent or better), 8GB+ RAM, and solid-state drives rather than mechanical hard drives whose moving parts prove less reliable under constant use and vibration from repeated touches.

Environmental Specifications: Review temperature operating ranges ensuring hardware functions reliably in intended locations. Standard indoor electronics typically operate 32-104°F, while outdoor-rated equipment should function from -20°F to 140°F depending on regional climate extremes. Similarly, confirm humidity ratings, dust ingress protection, and water resistance matching installation environments—particularly critical for outdoor or semi-protected locations.

Software Platform Capabilities and Flexibility

Hardware forms the foundation, but software determines actual functionality and long-term adaptability:

Content Management System Evaluation: Cloud-based CMS platforms should offer intuitive interfaces enabling non-technical staff to update content, modify layouts, and manage information without programming expertise or vendor assistance for routine changes. Evaluate template systems, media libraries, scheduling capabilities, approval workflows, and multi-user collaboration features matching your organizational structure and anticipated management approach.

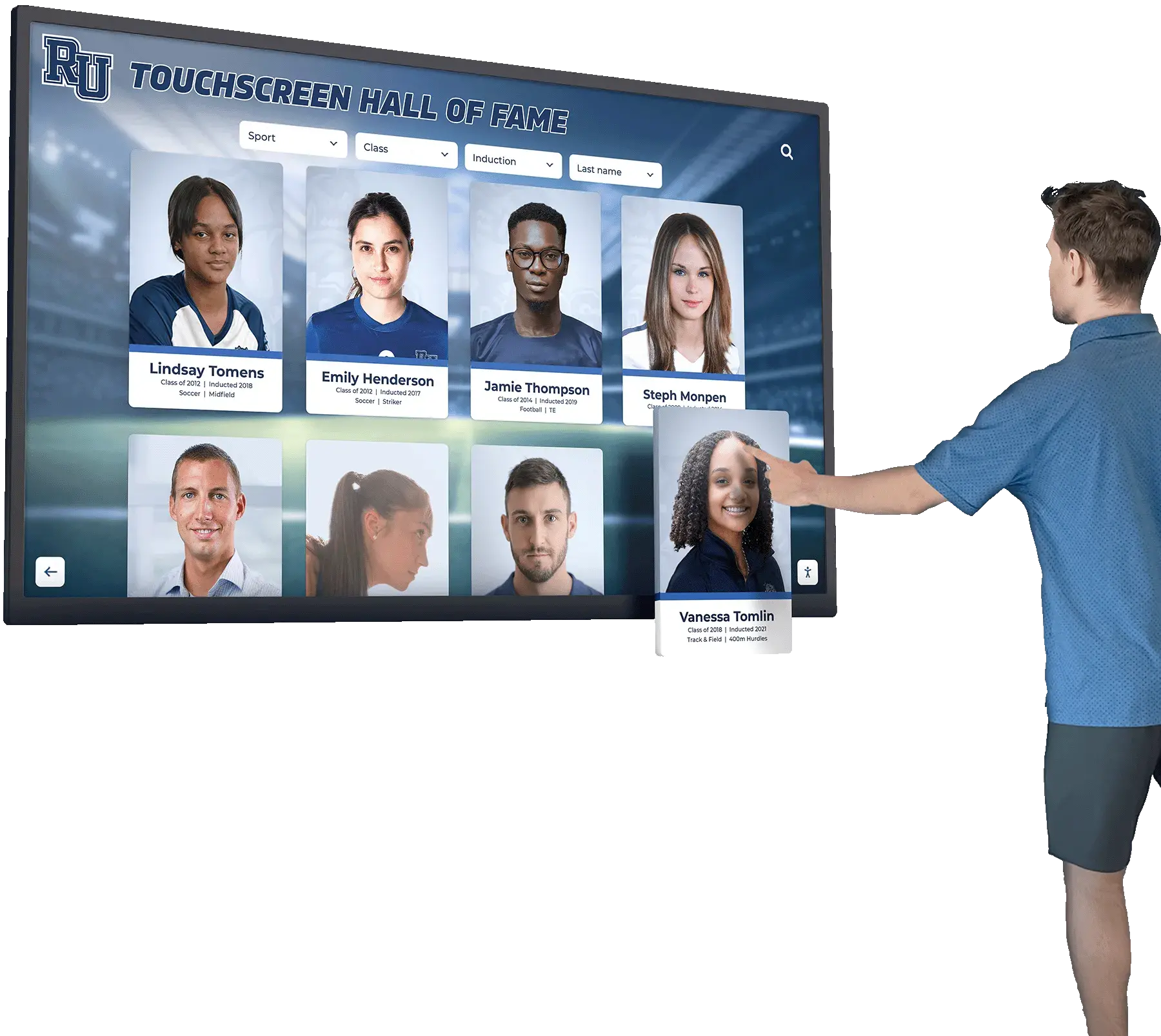

Map and Wayfinding Features: Purpose-built wayfinding software dramatically outperforms general digital signage systems adapted for navigation purposes. Specialized platforms provide interactive floor plans, route calculation engines, point-of-interest databases, search functionality, and wayfinding-specific interface elements that generic slideshow software cannot effectively replicate regardless of customization efforts. As demonstrated by interactive timeline displays, purpose-built solutions deliver superior engagement compared to adapted general-purpose platforms.

Integration Capabilities: Advanced deployments benefit from integrations connecting kiosk systems with property management databases, parking systems, tenant information sources, promotional calendars, and analytics platforms. API availability, supported integration protocols, and pre-built connectors for common retail systems determine how effectively kiosks function as part of comprehensive property technology ecosystems rather than isolated standalone tools.

Customization and Branding: Evaluate the ability to customize visual appearance matching property branding guidelines, color schemes, typography, and design language. Template-based systems may limit creative flexibility, while fully custom development provides maximum control at premium costs and longer implementation timelines. Balance branding importance against budget and timeline realities for your specific situation.

Analytics and Reporting: Review included analytics capabilities, available metrics, reporting interfaces, data export options, and visualization tools. Strong analytics programs provide actionable insights justifying investment and informing optimization, while weak reporting creates information blindness preventing evidence-based improvement and ROI demonstration to stakeholders questioning value.

Turnkey Solutions vs. Custom Development

Properties face fundamental choices between comprehensive turnkey solutions from single vendors and custom implementations assembling components from multiple providers:

Turnkey Solution Advantages: Integrated packages from specialized providers like solutions offering digital engagement platforms minimize implementation complexity by bundling hardware, software, installation, training, and ongoing support into single-source relationships. This approach reduces technical risk, accelerates deployment, and provides clear accountability when issues arise. Purpose-built systems designed specifically for customer engagement applications often deliver superior results compared to generic platforms adapted for uses beyond original design intentions, similar to how Rocket Alumni Solutions provides purpose-built recognition displays for educational institutions rather than forcing schools to adapt generic digital signage.

Custom Development Considerations: Building custom solutions from component hardware, open-source or commercial software platforms, and in-house or contracted development resources offers maximum flexibility and potential cost savings. However, this approach requires significant technical expertise, longer implementation timelines, and ongoing maintenance responsibility that many properties lack. Custom development makes sense for organizations with strong internal technology teams and highly specialized requirements that commercial platforms cannot address, but proves problematic for properties lacking dedicated technical resources.

Hybrid Approaches: Some implementations combine commercial hardware with customized software, licensed wayfinding engines with custom interface design, or commercial platforms with significant configuration and integration work. These middle paths balance flexibility against turnkey convenience but require careful vendor evaluation ensuring proposed customizations prove feasible within timeline and budget constraints.

Vendor Stability and Long-Term Support

Kiosk deployments represent multi-year investments requiring ongoing vendor relationships for software updates, technical support, and eventual hardware replacement:

Company Longevity and Financial Stability: Research vendor histories, customer counts, financial backing, and market positions providing confidence they’ll remain operational supporting deployed systems for 5-10 year typical hardware lifecycles. Startups may offer innovative features but carry higher risk of business failure leaving customers with unsupported orphaned systems. Established providers demonstrate staying power but may offer less cutting-edge capabilities than newer competitors.

Update and Enhancement Commitments: Confirm vendor commitments to ongoing software updates, security patches, feature enhancements, and platform evolution. Technology evolves rapidly—systems current at deployment risk feeling outdated within years without continuous improvement. Evaluate vendor product roadmaps, update histories, and customer feedback about responsiveness to emerging needs and changing technology landscapes.

Support Quality and Responsiveness: Technical support proves critical when systems malfunction or users need assistance. Evaluate support offerings including response time guarantees, available support hours, contact methods, on-site service options, and whether support costs are included in licensing or charged separately. Reference customer feedback about actual support experiences rather than relying solely on vendor promises about service quality.

Hardware Warranty and Replacement Programs: Commercial kiosks should include minimum 3-year warranties covering defects and component failures. Longer warranties reduce total cost of ownership by minimizing repair expenses during initial deployment years. Review warranty terms carefully understanding what’s covered, service response expectations, whether on-site repair or depot service applies, and whether vendors provide loaners during extended repairs preventing prolonged outages at critical locations.

Intuitive interfaces require no training or assistance, enabling spontaneous usage by shoppers of all ages and technical comfort levels encountering kiosks without prior experience

Implementation Best Practices and Success Factors

Technology capabilities matter, but successful deployments depend equally on thoughtful implementation processes, change management, and organizational commitment to long-term success beyond initial installation enthusiasm.

Planning and Preparation Phases

Rushing implementation causes preventable problems that careful planning avoids:

Stakeholder Alignment and Goal Setting: Begin by gathering input from diverse constituencies including property management, marketing teams, operations staff, tenant representatives, and ideally customer focus groups. Understand current pain points, desired improvements, success metrics, and potential concerns or resistance. Clear goal definition guides vendor selection, feature prioritization, and success measurement while building organizational support for investment and change.

Site Survey and Infrastructure Assessment: Conduct thorough site surveys at proposed kiosk locations assessing physical installation requirements, network connectivity availability, electrical power access, sightlines and visibility, accessibility compliance, weather exposure, and any unique environmental challenges. Comprehensive surveys prevent discovering infrastructure gaps after purchase that force expensive retrofits or compromised placement decisions.

Tenant Communication and Education: Proactive tenant communication explaining kiosk benefits, promotional opportunities, and information accuracy requirements builds support while preventing confusion or resistance. Tenants informed about kiosk features can promote them to customers, contribute content suggestions, and participate enthusiastically rather than feeling blindsided by installations they don’t understand or viewing them skeptically as property management initiatives providing no retailer value.

Phased Rollout Planning: Large-scale deployments often benefit from phased approaches starting with limited pilot installations, gathering feedback and usage data, optimizing based on lessons learned, then expanding systematically. Pilots reduce initial investment risk while enabling evidence-based refinement before full deployment, though extended pilot phases sometimes create unnecessary delays if planning proves thorough and vendor selection sound.

Installation and Launch Execution

Execution quality determines whether theoretical capabilities translate to actual customer value:

Professional Installation Standards: Engage qualified installers with commercial kiosk experience rather than general handyman services or attempting staff self-installation. Professional installation ensures proper mounting, clean electrical work, secure network connections, and adherence to safety codes and ADA requirements. Poor installation creates ongoing problems, professional appearance issues, and potential liability concerns that exceed savings from cutting corners during deployment.

Comprehensive Content Preparation: Complete full content development before public launch including accurate tenant databases, tested wayfinding routes, reviewed promotional material, verified amenity information, and finalized visual design. Launching with incomplete content, obviously missing information, or placeholder materials creates poor first impressions suggesting incomplete or unreliable systems that shoppers learn to ignore rather than trust.

Staff Training and Internal Launch: Train property staff, customer service personnel, and security teams on kiosk operation, common customer questions, basic troubleshooting, and when to escalate technical issues before public launch. Well-informed staff can assist confused customers, answer questions about functionality, and promote usage through recommendations. Similar to digital signage implementation best practices, internal launch periods allowing staff familiarization before public debut improve readiness while catching last-minute issues.

Soft Launch and Testing Periods: Activate systems for initial testing periods before major promotional campaigns, monitoring usage, gathering customer feedback, and addressing any technical glitches or usability issues that real-world testing reveals. Soft launches provide opportunities for refinement without pressure of major marketing announcements, ensuring systems work reliably before driving high-volume usage through promotional efforts.

Marketing and Customer Awareness: Promote kiosk availability through property signage, social media announcements, email marketing, tenant partnerships, and local media coverage. Education campaigns explaining benefits, demonstrating usage, and highlighting unique features drive initial trial and build awareness among shoppers accustomed to traditional wayfinding methods who might not spontaneously engage with unfamiliar technology.

Ongoing Management and Optimization

Long-term success requires sustained attention beyond installation enthusiasm:

Content Maintenance Discipline: Establish clear schedules and responsibility for regular content updates maintaining accuracy as tenants change, promotions evolve, and seasonal modifications occur. Stale content undermines credibility and trust—shoppers who encounter outdated information once often dismiss kiosks as unreliable rather than consulting them again. Calendar-based reviews catching changes proactively prove more effective than reactive updates after customers report problems.

Performance Monitoring and Technical Maintenance: Monitor system performance through remote management tools tracking uptime, response times, error rates, and hardware health metrics. Proactive monitoring catches emerging problems before complete failures, while scheduled preventative maintenance including cleaning, software updates, and component inspections extends hardware life and reliability.

Usage Analytics Review: Regularly analyze usage data identifying trends, opportunities, and areas requiring improvement. Which stores generate most searches? What amenities do customers struggle to locate? When do usage peaks occur? What promotions drive strongest engagement? Similar to how digital recognition systems track engagement patterns, data-driven insights inform content optimization, additional placement decisions, and strategic property management choices based on actual customer behavior rather than assumptions.

Customer Feedback Collection: Implement mechanisms collecting user feedback through kiosk interfaces, follow-up surveys, or prompted review requests. Qualitative feedback reveals usability issues, missing features, confusing elements, or desired enhancements that quantitative analytics alone don’t surface. Responsive organizations acting on feedback build customer loyalty while continuously improving experiences based on actual user needs.

Iterative Improvement Culture: Commit to ongoing optimization rather than “set and forget” mentality treating kiosks as static installations requiring no evolution after deployment. Technology advances, customer expectations change, and property needs evolve—successful programs embrace continuous improvement through regular updates, feature enhancements, and adaptations responding to changing environments rather than assuming initial deployments represent permanent final states.

Engagement with interactive displays extends beyond quick glances at static signage, with users spending minutes exploring content when interfaces prove intuitive and information proves valuable

Measuring Return on Investment and Success Metrics

Justifying kiosk investment requires demonstrating measurable value through quantitative metrics and qualitative improvements in customer experience and property performance.

Customer Experience and Satisfaction Metrics

Customer-focused measurements reveal whether kiosks achieve intended experiential improvements:

Customer Satisfaction Surveys: Direct feedback through intercept surveys, email follow-ups, or kiosk-integrated rating prompts asking “Did this kiosk help you today?” provide explicit satisfaction data. Track satisfaction scores over time comparing pre-kiosk baseline measurements against post-deployment results quantifying improvement from customer perspectives.

Wayfinding Success Rates: Observational studies or customer journey tracking revealing what percentage of shoppers successfully reach intended destinations after kiosk usage demonstrate practical effectiveness. High search-to-arrival rates validate that provided directions actually work, while low success rates suggest interface improvements, map accuracy issues, or physical signage gaps requiring attention.

Customer Service Inquiry Reduction: Monitor customer service desk questions before and after deployment, with specific attention to wayfinding and information requests that kiosks should address. Significant reductions in routine inquiries demonstrate kiosks successfully self-serve common needs, freeing staff for complex issues requiring human assistance while improving experiences for customers preferring self-service over asking staff.

Dwell Time and Visit Duration: Property-wide analytics comparing average visit duration before and after deployment reveal whether kiosks enable more comprehensive property exploration and shopping. Increased dwell time typically correlates with higher transaction values as customers visit more stores and discover additional shopping opportunities they would have missed without effective wayfinding.

Net Promoter Score Impact: Include questions about wayfinding and property navigation in Net Promoter Score surveys tracking overall customer advocacy. Improvements in navigation-related NPS components following kiosk deployment demonstrate measurable impact on likelihood to recommend properties to friends and family, a key indicator of overall experience quality.

Operational Efficiency and Property Performance

Business-focused metrics reveal whether investments deliver tangible operational value:

Tenant Sales Performance: Compare sales performance for stores featured in kiosk promotions versus those without prominent placement, controlling for store size, category, and typical performance. Some properties share anonymized tenant sales data revealing measurable traffic and revenue increases for promoted retailers, demonstrating concrete value justifying promotional fees or enhanced participation in property marketing programs.

Underutilized Area Traffic: Properties with low-traffic remote sections or second floors can measure foot traffic before and after wayfinding improvements highlighting these areas. Strategic kiosk promotion of underutilized tenants combined with clear directions to remote locations can demonstrably increase traffic to previously overlooked property sections, supporting leasing efforts for spaces buyers previously viewed as undesirable due to location.

Promotional Campaign Effectiveness: Track engagement with featured promotions through kiosk analytics, then measure subsequent store visit rates and reported sales impact. Data connecting promotion views to actual shopping behaviors demonstrate marketing value while informing optimal promotional strategies, content types, and featured store selection for maximum campaign effectiveness.

Lease Revenue Impact: Long-term tracking of overall property performance comparing periods before and after deployment provides highest-level business validation. While many factors affect overall performance, comprehensive tenant satisfaction, increased foot traffic, and improved customer experiences should contribute to stronger lease negotiations, reduced vacancy, improved tenant retention, and ultimately higher property values and investment returns.

Advertising Revenue Generation: For properties monetizing kiosk advertising inventory, track total revenue from tenant promotional purchases, advertising packages, and featured placement fees. Advertising revenue can offset substantial portions of kiosk operational costs or even generate net profit while simultaneously providing tenants with valuable marketing opportunities they willingly purchase.

Technology Performance and Utilization Metrics

Technical metrics reveal whether systems function reliably and achieve expected usage:

Uptime and System Reliability: Track system availability percentages measuring what percentage of time kiosks remain operational versus offline due to technical failures, network issues, or required maintenance. Commercial-grade systems should achieve 98-99%+ uptime excluding planned maintenance, with frequent outages indicating inadequate hardware specifications, insufficient network reliability, or poor vendor support requiring attention.

Interaction Volume and Frequency: Monitor total interactions, unique users, and sessions per kiosk daily providing fundamental utilization metrics. Compare actual usage against projections validating investment decisions, while location-by-location comparison reveals whether certain placements dramatically outperform or underperform averages, informing relocation decisions or additional deployment planning.

Average Session Duration: Longer session durations generally indicate engaging content and successful feature utilization rather than frustrated users abandoning unhelpful systems quickly. However, extremely long sessions might reveal usability problems causing confusion rather than engagement, requiring interface observation determining whether duration reflects value or confusion.

Feature Utilization Rates: Track what percentage of users engage different features—wayfinding, store search, promotions viewing, dining information, amenity locations. Underutilized features may need promotional emphasis, interface prominence increases, or removal if they provide insufficient value justifying maintenance burden and interface complexity.

Mobile Transfer and Extended Engagement: For systems offering mobile direction transfer or QR code scanning for additional information, track what percentage of users extend engagement beyond kiosk interaction. High mobile transfer rates indicate strong integration between physical and digital experiences, while low rates might suggest unclear value propositions or technical friction preventing seamless transitions.

Successful interactive displays generate extended engagement with users spending time exploring content rather than merely glancing at passive signage while passing

Future Trends and Emerging Technologies

Interactive kiosk technology continues evolving rapidly with emerging capabilities that forward-thinking properties should monitor for strategic advantage, though premature adoption of immature technologies carries risks.

Artificial Intelligence and Machine Learning Integration

AI capabilities increasingly enhance kiosk intelligence and personalization:

Conversational Interfaces and Natural Language: Voice-activated systems using natural language processing enable shoppers to ask questions conversationally rather than navigating menus—“Where’s the nearest Nike store?” or “Show me women’s shoe stores with sales today.” While still maturing for public self-service environments with ambient noise and varied accents, conversational interfaces show promise for more intuitive interaction, particularly serving elderly users or those with physical limitations making touchscreen navigation challenging.

Personalized Recommendations: Machine learning algorithms analyzing customer behavior patterns can suggest stores, routes, or promotions matching individual preferences inferred from previous visits, shopping patterns, or explicit preference input. While retail personalization raises privacy concerns requiring transparent data practices and opt-in consent, shoppers increasingly expect Amazon-like recommendation engines extending into physical retail environments.

Computer Vision and Gesture Control: Advanced systems might employ cameras enabling gesture-based navigation without physical contact, appealing to shoppers with hygiene concerns or disabilities preventing effective touchscreen use. Computer vision also enables demographic analytics understanding age ranges and gender distributions of kiosk users without requiring personal identification, informing content strategies and property marketing while respecting privacy.

Predictive Wayfinding and Proactive Assistance: AI systems might anticipate needs based on context—suggesting popular lunch destinations around noon, highlighting child-friendly stores to visiting families, or proactively offering parking reminders as shoppers complete visits. This contextual intelligence creates concierge-like assistance without human labor costs, though implementation requires careful balance avoiding creepy surveillance feelings that undermine rather than enhance experiences.

Augmented Reality and Immersive Experiences

AR technologies blur boundaries between physical and digital environments:

AR Wayfinding Overlays: Smartphone apps might overlay directional arrows, store highlights, or promotional information on camera views of actual physical surroundings, creating intuitive visual guidance as shoppers walk. While purely kiosk-based AR proves less practical, kiosk-to-mobile experiences initiating AR navigation on personal devices combine discovery convenience with enhanced guidance.

Virtual Store Tours and Product Previews: Kiosks might offer virtual store interior tours helping shoppers determine whether specific retailers warrant physical visits, or product previews showcasing key merchandise from multiple stores enabling efficient shopping prioritization without random wandering. While currently expensive to implement, costs decline as 360-degree photography becomes commonplace and content creation tools improve.

Gamification and Interactive Entertainment: Some forward-thinking properties experiment with gamified experiences rewarding property exploration through scavenger hunts, loyalty points for visiting featured stores, or interactive challenges creating entertainment alongside utility. While secondary to core wayfinding functions, entertainment features increase engagement particularly among younger demographics treating shopping partially as experiential entertainment rather than purely transactional errands.

Integration with Mobile and Omnichannel Experiences

Seamless physical-digital integration creates comprehensive customer experiences:

Kiosk-to-Mobile Continuity: Technologies enabling starting searches on kiosks then continuing on personal smartphones as shoppers walk create seamless transitions between discovery and navigation. QR codes, NFC tap transfers, or SMS-based information delivery connect stationary and mobile experiences without requiring app downloads or complicated transfer procedures.

Mobile App Integration: Property-specific apps might sync with kiosks enabling saved favorites, personalized recommendations, shopping lists, and accumulated loyalty points appearing on both platforms. This unified experience recognizes customers regardless of interaction channel, providing continuity traditional separate systems lack.

Curbside and BOPIS Integration: As buy-online-pickup-in-store becomes retail standard, kiosks might integrate order status checking, pickup location wayfinding, or mobile order placement for stores offering curbside service. This integration positions kiosks as omnichannel retail facilitators rather than purely physical shopping tools, remaining relevant as retail increasingly blends digital and physical dimensions.

Sustainability and Environmental Considerations

Growing environmental consciousness influences technology selection:

Energy Efficiency Improvements: Modern displays consume substantially less power than older generation screens while delivering superior brightness and visual quality. Properties prioritizing sustainability should evaluate energy consumption specifications, seek Energy Star rated components, and consider solar-powered options for certain outdoor installations, particularly in sunny climates where solar proves practical.

Digital Reduction of Print Waste: While obvious, quantifying environmental benefits from eliminating thousands of printed maps, directories, and promotional materials provides sustainability metrics aligning technology investment with corporate social responsibility commitments. Some properties achieve carbon neutral or carbon negative kiosk deployments when print reduction exceeds electronic operational footprints.

Long Lifecycle Design and Modularity: Sustainable approaches favor modular designs enabling component upgrades without complete replacements—swapping displays or computing modules while retaining enclosures and infrastructure. This approach reduces waste while enabling technology refreshes maintaining contemporary capabilities without wasteful disposal of fully functional structural components.

Touch-responsive interfaces provide immediate feedback to user inputs, creating satisfying interactive experiences that encourage extended exploration beyond initial queries

Conclusion: Strategic Value of Interactive Kiosk Investments

Interactive kiosks represent far more than digital replacements for static directories—they embody strategic investments in customer experience, operational efficiency, and data-driven property management that position outlet malls competitively in increasingly challenging retail environments. As e-commerce continues capturing market share and consumer expectations evolve toward seamless digital experiences, physical retail properties cannot afford communication approaches forcing customers to work hard discovering basic information or navigate confusing environments without intuitive assistance.

The business case for interactive kiosks extends across multiple dimensions. Improved customer satisfaction creates positive experiences that drive repeat visits and word-of-mouth recommendations. Enhanced wayfinding increases store visits, lengthens dwell time, and drives foot traffic to underperforming locations that might otherwise remain overlooked. Operational efficiencies reduce staff burden answering repetitive questions while providing flexibility updating information instantly without expensive physical signage replacement. Analytics provide unprecedented insights into customer behavior patterns, interests, and navigation challenges informing strategic decisions about tenant placement, promotional strategies, and capital improvements. Additional revenue opportunities through advertising sales offset operational costs while providing tenants with measurable marketing value.

Successful deployments share common characteristics—clear strategic goals guiding implementation rather than technology for technology’s sake, thoughtful placement maximizing visibility and convenience, intuitive interfaces enabling self-service without frustration, compelling content maintaining accuracy and relevance, reliable hardware surviving demanding public environments, and organizational commitment to ongoing management beyond initial installation enthusiasm. Properties approaching kiosks as long-term strategic assets requiring investment in quality hardware, professional implementation, and sustained management achieve dramatically superior results compared to those treating them as one-time technology purchases requiring no ongoing attention.

The outlet mall kiosk market offers diverse options ranging from basic digital directories through sophisticated interactive wayfinding platforms integrating advanced features like personalization, mobile connectivity, and comprehensive analytics. Selection requires matching capabilities to specific needs, budgets, and technical resources rather than assuming one solution universally suits all properties. Smaller properties with limited budgets might start with basic implementations providing core wayfinding functionality, while large premium outlets justify comprehensive systems with advanced features that maximize customer engagement and business intelligence.

Solutions like Rocket Alumni Solutions demonstrate how purpose-built platforms designed specifically for community engagement and recognition deliver superior results compared to generic technologies adapted for specialized applications. While Rocket focuses on educational recognition rather than retail wayfinding, the principle applies universally—specialized solutions designed for specific use cases typically outperform general-purpose technologies customized for applications beyond original design intentions.

Your customers deserve intuitive wayfinding experiences matching the convenience and personalization they’ve come to expect from digital services in every other aspect of their lives. Interactive kiosks provide practical tools ensuring visitors—whether first-time explorers or regular shoppers—can efficiently navigate properties, discover relevant stores and promotions, and access needed amenities without frustration or staff assistance. When implemented thoughtfully with quality technology, strategic placement, compelling content, and sustained management, these systems become more than wayfinding tools—they become ongoing expressions of customer service excellence and property sophistication that differentiate your outlet mall in competitive markets where experience matters as much as merchandise and pricing.

Ready to Transform Your Outlet Mall Customer Experience?

Discover how purpose-built interactive display solutions can help your property create engaging wayfinding experiences that increase customer satisfaction, drive foot traffic, and provide valuable insights through proven platforms designed specifically for community engagement needs.

Schedule Your Free Consultation